Is fear of monetary collapse driving the elite's response to a flu-like virus?

Sliding down a slippery slope

I have been present on two occasions at London's Speakers' Corner, during the Covid panic, to watch the police step in and stop perfectly calm non-violent speakers from expressing their views. Both times the silencing was done forcefully with handcuffs. In the one case I was able to follow up on, Dr Heiko Schöning was released without charge but only after eight hours in a police cell. The sublime irony, of course, is that Speakers' Corner is supposedly an ancient home of free speech.

Historians of the future might look back on this era as one more episode where, consumed by fear, our society panicked and did stupid things. This is how we look back at past episodes of hysteria, such as sixteenth-century witch hunts or the "red scare" in 1950's America. In the latter example, an epidemic of fear and paranoia spread and individuals suspected of transmitting the "communist" virus were persecuted. Once the madness had passed, the deluded immediately became the amnesiacs and disowned the whole affair. It was always other people that had pushed for the bad things.

The future history of covid will have all these features, but there is much more to our current emergency.

Nothing makes any sense any more

Many of us have been bewildered by covid; despite the fashionable cries of "follow the science", normal reason and logic seem to have been suspended.

For example:

-

Why spend billions on covid testing even after the FDA has said test kits in wide use should be destroyed, literally "place them in the trash"?[5] About £100 billion was allocated to the UK "Moonshot" testing programme and resulted in very modest achievements, if any at all, which compares to the NHS's continually stretched budget of less than £200 billion.

-

Why press ahead with vaccinations - that do not stop transmission - for teenagers who are not at risk of the virus but who may be damaged by the vaccine?

-

Why restrict access to healthcare so that waiting lists for treatment - including many cancer sufferers - break all records? Recently it was noted that there are 5.6 million people waiting for initial treatment [6].

How can such policies possibly serve the goal of better public health?

The crumbling narrative

In so many places, if you test the official covid narrative, it seems to crumble under a weight of contradictions, falsehoods and misrepresentations. The world is not usually this irrational. Past paranoias have not stretched so far and so deep.

Of course "big pharma" is in it for the money, they always were, but such corruption hardly begins to explain how we could fall so far into such a deep, dark hole. This doesn't explain how, in a matter of months, we turned the whole world upside-down, making it normal to destroy livelihoods and liberties, normal to focus all attention on one illness at the expense of others that kill many more, and now normal to coerce people into getting an unproven medical intervention or risk losing freedoms to work, study or to travel. Forcing medical interventions on people against their will is something many thought the post-war Nuremberg trials might banish forever, at least from so-called democracies.

A new "lens"

When you look through the lens of "how does this improve public health?", our collective response to covid makes no sense at all. Another lens is needed. One lens that brings at least part of this into meaningful focus is characterised by a question: "how would the financial elite respond to fear of monetary collapse?"

The fault is not in our stars, but in our money

To understand this "lens", we need to think a bit about money. What follows is a simplification for the sake of brevity.

"Where does money come from?" is a simple but very important question. For several decades now, the world's major currencies have not been tied to any real asset. The post-war "gold standard" - where the world's currencies could be exchanged for dollars which in turn could be exchanged for gold - was cancelled by President Nixon one weekend in August 1971. As a consequence, nations became free to create unlimited amounts of money.

It is, perhaps surprisingly, routine for banks to create money by lending money they don't have, providing they have a small percentage of capital in reserve. This means, if too many depositors seek to withdraw funds at the same time, the bank will collapse in bankruptcy - through a "run on the bank".

Lending money into existence

When banks create money out of thin air, by lending it into existence, this money will appear perfectly real to all who buy and sell with it and invest with it and charge interest on it. Of course those who profit from the transactions will put their money in other banks, enabling those banks in turn to lend yet further multiples of the amount deposited. Round we go in circles of exponentially growing money supply - and corresponding debt, as this money is loaned, not gifted.

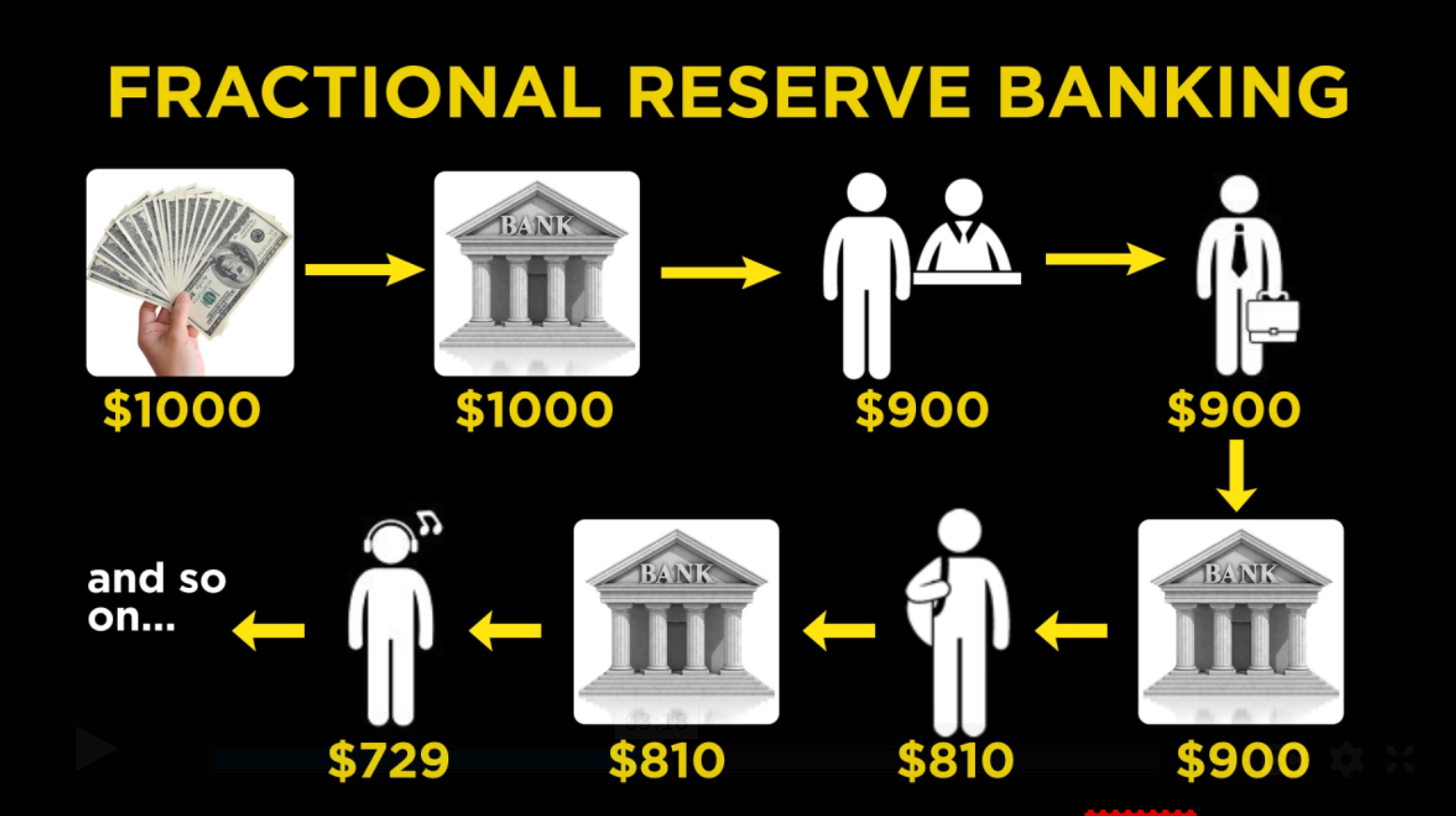

In the above example[9] $1000 is deposited in the bank, which facilitates a loan of 90% of capital held which is $900. This then gets deposited somewhere, enabling a further loan of $810, which once deposited enables a loan of a further $729.

In just three steps, $1000 has magically generated a further $2439 (900 + 810 + 729) out of thin air. The initial $1000 has more than tripled to $3439. This is of course is a simplified microcosm of a much bigger process, that stretches out across decades but illustrates how money is loaned into existence.

"Fiat" money provides freedom...

Welcome to the rather surprising world of "fiat" money, so called because the money has value only because of the government's decree, or fiat. A fiat currency, such as the dollar or the pound, by definition, has no intrinsic value, unlike for example a real gold coin which could be melted down and used for something.

A convenient thing about our current monetary system is that when governments have a problem, the Central Bank can lower interest rates, which will speed up the process of money generation so there is more to go around. Thus, in a recession, if money supply is accelerated, there will be more customers with money in their pockets, businesses find it easier to borrow money to make goods, and the economy will pick up again.

Of course there may be a tendency for the economy to "overheat" - more money chasing the same goods means inflation. Inflation devalues currency and fluctuations make it hard for businesses to plan ahead and maintain appropriate profit margins. To control things, the government can raise interest rates and slow the process down again.

Economists have argued whether this is a good thing ("Keynesians") or a bad thing ("Monetarists"), but their argument has not stopped the process from continuing relentlessly.

Arguably, while policy makers have been distracted by various arguments around the topic, they have ignored the problem at the heart: the money in circulation is always increasing, usually exponentially. One good reason for them to ignore it is that they had absolutely no solution to it other than "wait and see" and "hope for the best". John Maynard Keynes, the father of Keynesian economics, did have a solution of sorts. He famously said "In the long run we are all dead". He and his contemporaries are now long departed; so he was right about that at least. When in 1999, Time Magazine named Keynes as one of the "Most Important People of the Century" they said:

"His radical idea that governments should spend money they don't have may have saved capitalism" [13].

In hindsight, we can see a certain naivety in this statement. Keynes did not save capitalism; he merely postponed the day of reckoning.

Fiat money has a big problem

After a few decades of fiat money, we now find ourselves surrounded by absurdly vast quantities sloshing around. At the time of writing, US Money Supply is up to about $21 trillion, which is around 125% of Gross Domestic Product and growing fast; in 2000 the same ratio was "only" 56%. The problem is not limited to the USA; the UK's ratio has suddenly shot up from around 75% to 100%, while in Japan, which boasts the third-biggest economy in the world, the ratio is roughly double that of the USA.

These huge sums of money flow back and forth between the players in finance, insurance and real estate (there is around $600 trillion outstanding in currency and credit derivatives trading alone). Fortunes are made and debts are built up that hardly relate to anything in the real world. Some of the players become so big they become "too big to fail", as their failure would risk bringing down other institutions with them in a devastating domino-style collapse.

No one should underestimate how nasty it might be if your cash card stopped working and your local supermarket could not pay their suppliers, and the police stopped going to work because no one could pay them, and then the electricity goes off in the hospital, etc. In the credit crunch of 2008, then-Chancellor Alistair Darling said that Britain came within hours of "the breakdown of law and order" - averted by a massive bail out of the Royal Bank of Scotland, at the time the world's biggest bank. [12]

Putting out fires with gasoline

To prevent economic meltdowns from happening, governments have got into the habit of pouring "printed-out-of-thin-air" money into trouble spots, billions and trillions of dollars, to keep banks solvent and money flowing. These actions are known as "bail-outs" or more euphemistically as "quantitative easing" and in the UK have become pretty much a permanent feature of our economy. It is very like smothering flames with gasoline. It might work in the short term (don't try it at home) but in the longer term, by adding fuel to the fire, you are just making things worse.

As money supply rockets up an exponential curve, it would be unsurprising if things started to get out of control. Money lent into existence also creates vast debts that must be serviced and can never be repaid, which makes people nervous - and rightly so. The whole thing starts to resemble a very fragile house of cards. In this environment, governments will set interest rates lower and lower to keep the money flowing. Raising interest rates gradually ceases to be an option due to the crippling effect it might have to the many who have large debts.

The crunch!

When interest rates reach zero and can go no further and when the next major insolvency comes along, there comes a point where government interventions can only lead to hyperinflation - which benefits nobody. The rather clumsy tool of interest rate control is stuck on zero.

For policy makers, whatever their political stripe or economic persuasion, there is nowhere left to go. It is an awful crunch moment - if you act you are doomed; if don't act you are also doomed. The system we are all part of, have grown up with and all benefited from has proved to be unsustainable.

Very roughly speaking, this is the awful point we may have reached in 2019. Now imagine you were a rich and powerful elite capitalist, anxious not to lose your elevated place in society as the value of your money is about to be rinsed away in a storm of hyperinflation.

Autumn 2019: the telephone rings

"Hi Billy this is Claas."

"Hi Claas."

"I'm afraid ze time has come."

"Oh really? That sucks. Really? Can't you tell the Fed to drop just a few more trillions?"

"It's the zombie banks."

"What's the problem?"

"It's spreading everywhere. People are noticing; they are nervous. The Banks may get the runs."

"Oh that's too bad. Is there really nothing left to print?"

"No, interest rates are zero, there is no "lower". We can't wait any longer."

Billy was quiet for a moment, then began softly:

"You know I have a lot of dollars, I mean a lot. I really don't want this to happen."

"Ja, I know. But Billy, you know it has to. The hyperinflation is coming. The great depression and the credit crunch will be walks in the park compared to this."

"Damn. That's bad. Can't you stop this? Think of all the poor people who'll lose their jets!"

"Don't worry so much. We will have a Great Reset".

Claas starts to explain the Great Reset:

"First, freeze the economy like the meat in the freezer."

"Okaay?"

"We'll clean it up. All the little companies gone. Much easier to have a call with Jeff when you want something."

"OK, so we freeze the economy, then what?"

"Then we replace the old money. We'll call it the liberty passport or something. Everyone must have it. They will even want it, ha ha ha ha."

"So it's no longer us with the most money who win every time? I liked that system."

"No not any more, old money no good. Now it's points for good behaviour. So much better than the old way. No more everything for the rich one per cent. Not any more. The computer money is fairer - rewards for good people, compliant helpful people, not rich mouthy people. A much better world. We will make our mothers proud."

"I am, by most people's standards, a rich man, remember Claas."

"Yes, and mouthy, ha ha ha, but you will own nothing, and you will be happy [11], ha ha ha ha. Billy, don't take it so serious. We will control everything! And with the computer money, we take it back as easily as we give it, Billy - you take as much as you like."

Billy sighs with relief.

"Claas, I'm so glad you're in charge."

"Yes, it's perfect! This time, money will not get out of control. So much better for everybody! We make history. And we shut down the internet trolls. Rude and we switch their money off. No need to even call Jack!"

"Good. I hate trolls."

They discuss the roll-out of the plan:

"Claas how are we going to get this done? Xi is so organised. But the free world? Joe is losing it. The Brits are useless, remember Brexit? East Europe's a mess, and South America, oh my! How do we control these hordes?"

"Don't worry Billy, and here's the idea: next year, in 2020, we have a scary virus, really scary. We can use a new one or the flu, it doesn't matter. No one can stop a virus - at least not the idea of one. It will be the same for everyone, all countries. We will be fair. It will all fall into place. You'll see."

"What about some terrorism?"

"No. Virus is the best option. Terrorist story is too old and is over too quick. Climate crisis on other hand, is very good but we keep that for afterwards, ha ha ha."

"Claas, how long will this last? It's going to be bad for civil liberties."

"Billy, you are funny! We keep everyone in the suspended animation until we are ready - people safe in their houses with a mask on every one. Then when we are ready, all is done and reset, we let them out again, no problem, no harm done. Maybe we keep the masks, I think the little people look better in them."

"OK, a virus. I thought so, Good job Claas. That's why I bought the WHO and the CDC. I'll read up on viruses, really nasty ones, I'll spread the word far and wide. It's going to be scar-eey, wuuuh!"

"Billy you are an egg. Thank you. That will be so helpful."

Claas pauses and lowers his voice:

"This is going to be a bloody mess, you know that?"

"Yes I know. But then we'll Build Back Better?"

"That's right Billy, Build Back Better You've really got this now. OK well that's all for now."

"Well thanks again for all you do Claas, and say hello to Mrs Gotha would you?"

The "Monetary Plandemic" Hypothesis

Claas and Billy are imaginary characters and the individuals are not important. If the real people that hold sway in digital-financial elites were not there, others would replace them. Just as a gangster "family" will likely endure, even if its head should not.

In dollar terms, it is the super-rich that have the most to lose and who would have the means and motivation to try and "reset" the monetary system in a way that maintains their advantageous position in society.

Support for the hypothesis:

What support is there for the "Monetary Plandemic" hypothesis? If governments' overriding concerns were the monetary system rather than public health, it would explain why...

-

the risks and consequences of covid illness have been greatly exaggerated

-

evidence that interventions are ineffective is ignored, censored and suppressed

-

conventional cost-benefit analyses of interventions are not done

-

the apparent damage done to the global economy is ignored, with huge negative public health consequences

-

previously fiscally prudent and business-oriented governments appear content to destroy businesses with lockdowns, while throwing away eye-watering sums on furlough payments and testing

-

people are put under great pressure to accept vaccine passports, despite the vaccines doing very little, if anything, to stop transmission. As children use money, they too must be pushed into a digital ID system via a vaccine passport programme, even if vaccination makes no medical sense for them

-

political leaders across the western world are attached to slogans such as the "Great Reset" and "Build Back Better", which appear to be independent of the party-political programmes that in the past have driven national democratic agendas

-

the covid "crisis" never ends, even when the virus has dwindled to relative insignificance. The crisis needs to continue until a monetary "reset" has taken place regardless of public health considerations. Each covid policy goal such as "three weeks to flatten the curve" is replaced by an endless narrative of "scary variants", "a circuit breaker to save Christmas", avoiding "another lockdown". Further covid restrictions have started to seem as inevitable as death and taxes

Are there signs of monetary collapse?

The theory that a fiat currency must have a finite life span seems irrefutable, but will that end come tomorrow, in one year or in one hundred years? Predicting the future is a fool's game, but there are signals there are cause for concern now.

The 2019 Repo market crash was perhaps as important as it was under-reported. Here is how it was described at the time by Forbes magazine:

"Last week the financial system ran out of cash. It was a modern version of a bank run, and it’s not over yet...Somebody—probably a big bank—needs cash so badly that it has been willing to pay a shockingly high cost to obtain it. That’s the layman’s explanation of what’s happening. Interest rates have betrayed common sense" [1]

The 2019 problem was "solved" with more bailouts of hundreds of billions of dollars being pumped into the markets on a weekly basis.

A main signal that a monetary collapse was happening would be very high inflation, leading to a breakdown of financial and economic systems. As I write this, it is easy enough to scan the news and find troubling headlines:

Daily Telegraph: "A looming 'cost of living crisis' could erupt into the biggest political issue of the decade, senior Tories have warned" [2]

The Executive Intelligence Review: "In continental Europe and the United Kingdom, a hyperinflationary rise in energy prices over the course of 2021, and resulting bankruptcies and shutdowns of critical industrial production, has now unleashed a chain reaction of breakdowns of the physical economy of strategic proportions" [3]

The Independent: ‘Biggest crash in world history’: Personal finance expert Robert Kiyosaki predicts economic crisis in October [10] (Kiyosaki is author of the "Rich Dad" series of financial education books)

Central Banks are developing digital currencies

Countries from Uruguay to the UK are either investigating or developing digital currencies, often referred to as Central Bank Digital Currencies or CBDC's [7].

In October 2020, the head of the Bank for International Settlements, often thought of as the central bank for central banks, declared that he wanted “complete control” over money via banning cash in favour of Central Bank Digital Currencies, calling it a “very important” goal. Watch the video linked below.[14]

What should we do?

Here are some quick thoughts on what could be done to offset the harms that might be caused by a monetary collapse and the elite capitalists' response to it:

-

Most important, resist moves towards digital IDs and digital currencies that are controlled by authoritarian groups - such as the current UK government - or the algos of "Big Tech".

-

Once our money is digitalised, liberties we have both fought for and taken for granted will fade and become very difficult to recover. Beware of the Central Bank Digital Currencies, or CDBC's[4]. Beware of an initial incarnation of the digital ID that comes disguised as a "Vaccine Passport" or some other ID such as a "Citizen's Digital Wallet" created in response to energy or food shortages. Such digital systems may appear useful in the short term, but they risk being deadly to liberty and a catalyst to the complete surrender of power to authoritarian technocrats at the expense of democracy.

My view is that people should fight any government-controlled digital IDs - that will be a precursor to digital currencies - tooth and nail. -

If (should it be "when"?) hyperinflation strikes, paper assets will lose value dramatically. This includes any savings in your bank account or pension. Consider alternative stores of wealth such as precious metals, or open source digital currencies such as Bitcoin, that cannot be controlled by a central authority. Buy a farm! (Perhaps Bill Gates has had similar thoughts, he is now the biggest owner of Farmland in the USA.)[8]

-

Develop your connections within your local community. Should there be significant instability in the global monetary system, good local connections will enable you to manage this better than if you are merely a consumer of products provided by large remote retailers.

-

Educate yourself about these issues (see links below).

The hypothesis in a nutshell

A collapse in our monetary system is the driving force behind a "covid plandemic" of irrational health policies. The covert goal is to replace existing fiat currencies with digital currencies linked to digital IDs. The power elite driving this agenda wish to maintain their wealth and power despite the collapse of the monetary systems upon which their empires are built. To achieve this, they will need to subvert democratic structures in favour of their own authoritarian controls facilitated by digitalisation. In this dystopia, democracy is sidelined and ordinary people must conform "correctly" or suffer immediate digital consequences.

Imagine being charged a higher tax rate because your social media posts were determined to have failed "fact-checking". Imagine having your wages docked because your contraceptive injection has expired. Imagine discovering you are unable to travel due to your "unrepresentative" opinions. Imagine your campaigning organisation or place of worship is closed for promoting "unhelpful" values.

Imagine that these decisions and policies are executed in algorithms managed by profit-focused corporations that are controlled by the mega-wealthy, for whom democratic oversight is little more than a distraction.

The possibilities of authoritarian regimes being in control of digitalised currencies and identities are endless and terrifying. It is the stuff of nightmares, the death knell of democracy and to be resisted by all possible means.

Further study

A German financial journalist

The topics covered above are vast in scope, and probably deserve years of study; events however will not wait so long.

I urge you to watch this speech by Ernst Wolff, a journalist and author specialising in financial matters. He provides credible context together with grounds for hope and optimism. This video is in German with subtitles, a detail that I soon forgot, once into the message delivered with passion and clarity: Ernst-Wolff, Uncovering the Corona Narrative, Aug 2021

An Italian professor from Wales

Another great perspective on these issues is provided by Fabio Vighi, Professor of Critical Theory and Italian at Cardiff University. He traces in illuminating detail some of the financial steps that have led us to where we are:

If we ‘follow the money’, we will see that the economic blockade deviously attributed to Virus has achieved far from negligible results, not only in terms of social engineering, but also of financial predation

Like Wolff, Vighi also concludes that the "global coup" is doomed to fail. The whole article is worth reading in full: A Self-Fulfilling Prophecy: Systemic Collapse and Pandemic Simulation, The Philosophical Salon, August 2021

An Economics researcher from the USA

Chris Martenson is an Economics researcher who has published extensively on the problems with our monetary system. For him, these monetary problems are just one aspect of the three "E's" (Economy, Environment and Energy), where he sees trends coming together in a perfect storm. His four-and-a-half-hour "Crash Course" is well worth the time spent. Here is a one-hour distillation of that material:

The Accelerated Crash Course from Peak Prosperity on Vimeo.

Let me know what you think of this article, by commenting on Telegram here: https://t.me/InProportion2discussion

Notes and References

-

The Real Story Of The Repo Market Meltdown, And What It Means For Bitcoin, Forbes, 25 September 2019

-

Interesting suggestion that Energy Crisis could be bigger than Covid: Energy crisis could erupt into 'biggest political issue of decade', Tories warn, Telegraph, 20 September 2021

-

"A 2021 BIS survey of central banks found that 86% are actively researching the potential for CBDCs, 60% were experimenting with the technology and 14% were deploying pilot projects." BIS Innovation Hub work on central bank digital currency (CBDC)

-

America’s Biggest Owner Of Farmland Is Now Bill Gates, Forbes, 24 Jan 2021

-

For people to "Own Nothing and Be Happy" is part of the vision communicated in a video promoted by Klaus Schwab's World Economic Forum. “Own Nothing and Be Happy: The Great Reset’s Vision of the Future", Off-Guardian, 12 November 2020

-

October 2020, the head of the Bank for International Settlements, often called the central bank for central banks, declares he wants “complete control” over money via banning cash in favor of Central Bank Digital Currencies... an openly stated “very important” goal

The head of the Bank for International Settlements, often called the central bank for central banks, declares he wants “complete control” over money via banning cash in favor of Central Bank Digital Currencies... an openly stated “very important” goal.

— Swan 🦢 SwanBitcoin.com 🚀 (@SwanBitcoin) March 19, 2021

pic.twitter.com/BNMOEi5iGu

Photo credit Tiana Attride on Unsplash